A federal jury in Texas has awarded Netlist $118 million in damages for patent infringement by Samsung.

Netlist, founded in 2000, is a Delaware company headquartered in Irvine, CA. According to its website, it “specializes in hybrid memory – the merging of DRAM and NAND flash raw materials to create memory solutions.”

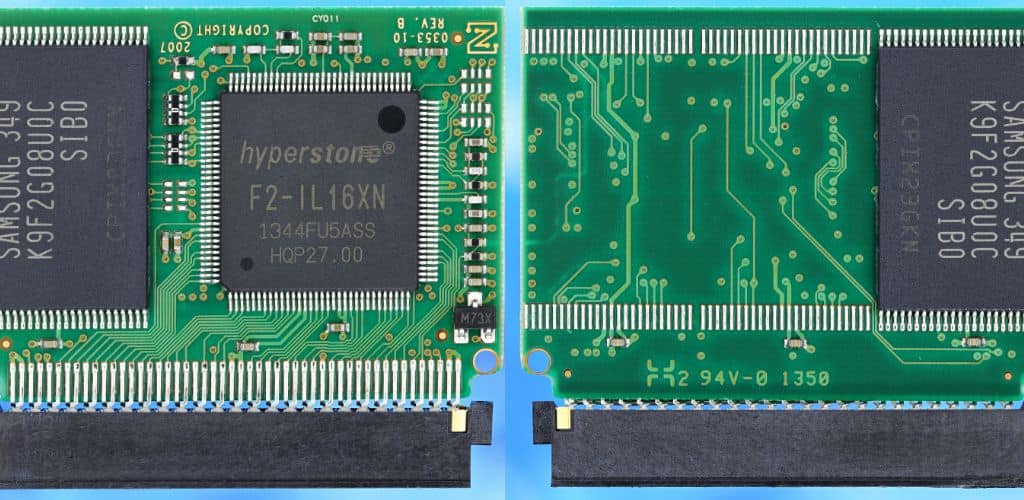

The case involved three Netlist patents: U.S. Patent Nos. 7,619,912, 11,093,417 and 10,268,608. The infringing products were all Samsung DDR4 RDIMMs and DDR4 LRDIMMs.

As Reuters reported,

Netlist sued Samsung in 2022, alleging that the Korean tech giant’s memory modules used in cloud computing servers and other data-intensive technology infringed its patents. Netlist said its innovations increase the power efficiency of memory modules and enable users to “derive useful information from vast amounts of data in a shorter period.”

According to FS,

Registered DIMM (RDIMM) is a type of memory module commonly used in servers and high-performance computing systems. RDIMM modules contain a register that buffers command and address signals to the system’s memory controller.

A LRDIMM is a Load-Reduced DIMM. According to Dasher Technologies,

LRDIMMs use memory buffers to consolidate the electrical loads of the ranks on the LRDIMM to a single electrical load, allowing them to have up to eight ranks on a single DIMM module. Using LRDIMMs you can configure systems with the largest possible memory footprints. However, LRDIMMs also use more power and have higher latencies compared to the lower capacity RDIMMs.

Samsung argued that the Netlist patents were invalid and that Samsung’s technology did not infringe the Netlist patents.

As Reuters noted, Samsung filed a related lawsuit in a Delaware federal court accusing Netlist of breaking an obligation to offer fair licenses for technology required to comply with international standards.

According to the Korean Maeil Business Newspaper,

Standard Essential Patents (SEP) refers to standards that must be followed in common by several companies in the industry or technology field. Companies with standard essential patents must provide licenses for other companies to use the technology in accordance with the FRAND principles (Fair, Reasonable, and Non-Discriminatory). Samsung Electronics believes that Netlist does not follow these FRAND principles, make excessive demands on technologies essential to international standards, or did not provide licenses to Samsung Electronics under unreasonable conditions.

The jury in the latest Texas case also found that Samsung willfully infringed the patents. This could lead to the judge trebling the damage award.

In April 2023, Netlist won a $303 million patent infringement damages award against Samsung. In that case, Netlist had previously licensed the patents at issue to Samsung, but Samsung allegedly continued to knowingly use products that infringed three of Netlist’s patents after the licenses had expired.

In May 2024, Netlist won a $445 million patent infringement damages award against Micron Technology, Inc., Micron Semiconductor Products, Inc. and Micron Technology Texas LLC.

C.K. Hong, Netlist’s Chief Executive Officer, said in a press release about the latest verdict,

In the past 19 months three separate juries have awarded Netlist $866 million in damages for the willful infringement of our patents. These verdicts are among the largest in the semiconductor industry during this period and highlight the tremendous value of our intellectual property. Exposure to our patents continues to accumulate as volume of memory products for AI see explosive growth. Netlist is committed to securing fair value for the unauthorized use of our patents.

Seeking Alpha has suggested that “Netlist’s survival hinges on receiving settlement payments before running out of cash, making it a highly speculative but potentially high reward play,” and noted that “Despite high legal expenses, NLST has a cash runway of 6-8 months in a conservative case, and up to 12-14 months if they secure additional credit or equity.”

Just like the haiku above, we like to keep our posts short and sweet. Hopefully, you found this bite-sized information helpful. If you would like more information, please do not hesitate to contact us here.